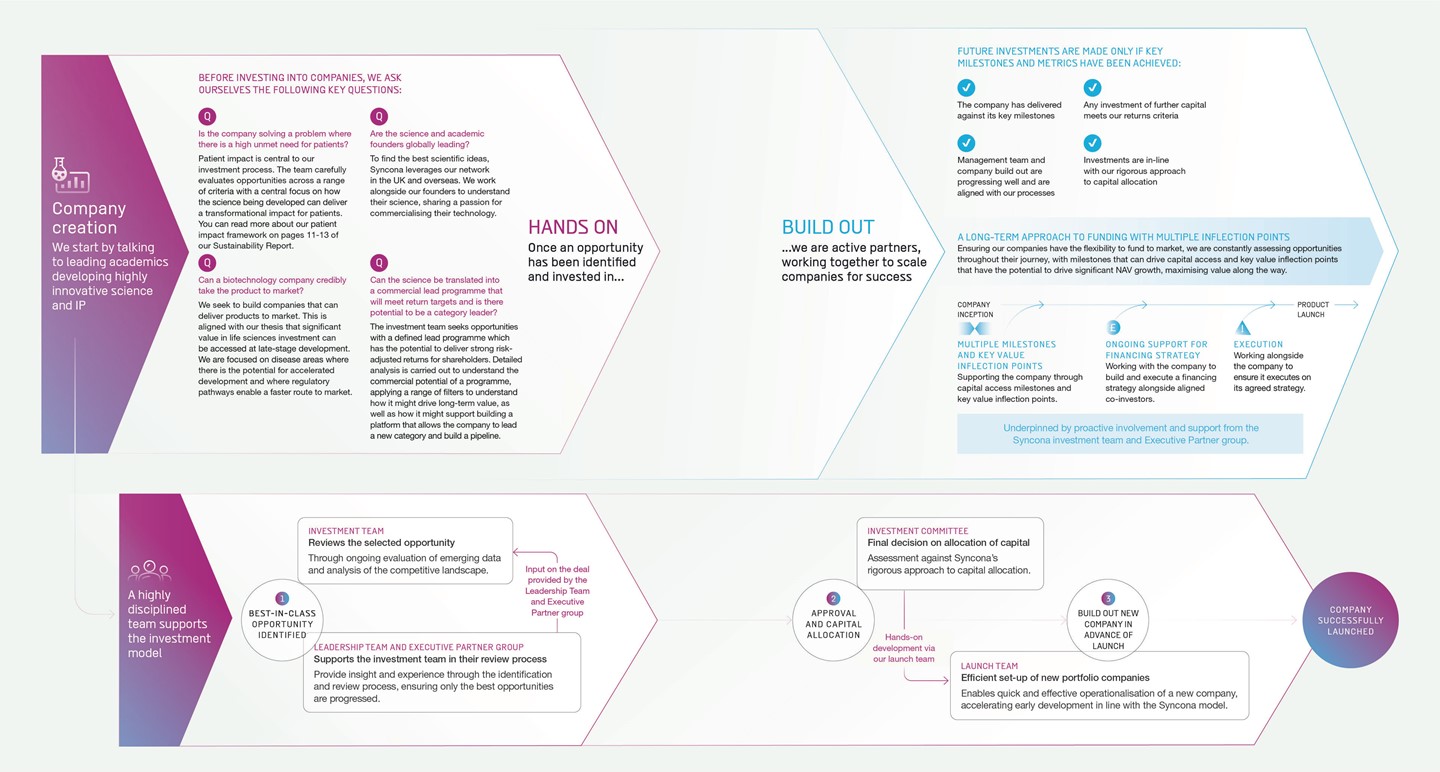

We take a proactive approach to sourcing science with a focus on how it could translate to products that can deliver transformational efficacy for patients in areas of high unmet need. We then apply our rigorous due diligence process.

Company creation for us starts by talking to leading academics developing highly innovative science and IP.

Our team’s background in basic science, clinical development and commercialisation enables a holistic understanding of the opportunity and enables us to bring the commercial vision to form a company that can take a product to market and patients.

We take a proactive approach to seeking out scientists from leading universities and then conduct rigorous due diligence to identify the range of key risks and opportunities, in line with our disciplined capital allocation policy.

Investment team

- Reviews the selected opportunity.

- Through ongoing evaluation of emerging data and analysis of the competitive landscape.

Leadership team and Executive Partner group

- Supports the investment team in their review process

- Provide insight and experience through the identification and review process, ensuring only the best opportunities are progressed.

Investment committee

- Final decision on allocation of capital.

- Assessment against Syncona’s rigorous approach to capital allocation.

Launch team

-

Efficient set-up of new portfolio companies.

-

Enables quick and effective operationalisation of a new company, accelerating early development in line with the Syncona model.